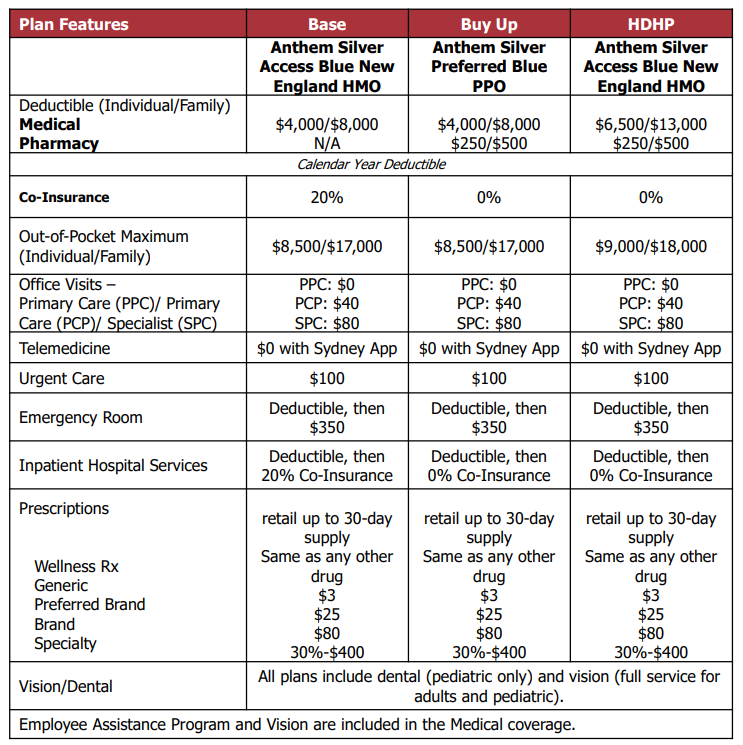

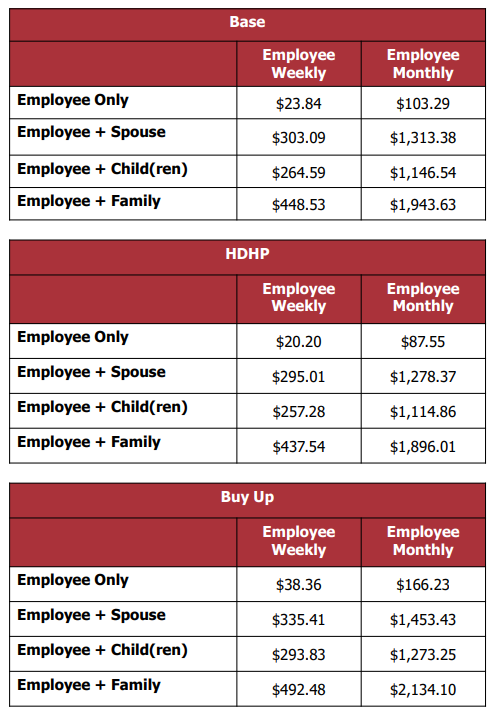

My Medical Benefits

Well-Being Resources

Discount Programs for Weight Loss

My Health Reimbursement Arrangement Benefits

My Health Reimbursement Arrangement Benefits

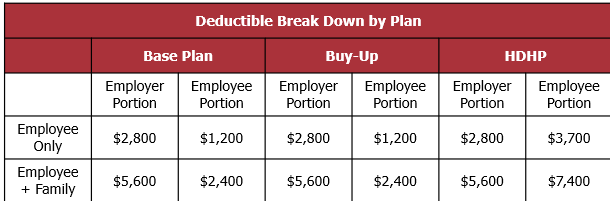

A Health Reimbursement Arrangement (HRA) is a promise to reimburse or pay a specific amount toward insurable medical expenses incurred by a participant. You must be enrolled in the HP Cummings Medical Plan to be eligible for this benefit.

HP Cummings Construction Co. will contribute $2,800 for singles or $5,600 for families to cover the cost of medical deductible expenses in the form of a cost share.

Flores will administer the HRA. Employees will be paid directly from your HRA by Flores when funds are available.

If you enter the plan at a time other than the beginning of the plan year, the amount credited to your account will be reduced to reflect the time of actual participation.

My Limited Purpose Health Reimbursement Arrangement Benefits

My Limited Purpose Health Reimbursement Arrangement Benefits

A Health Reimbursement Arrangement (HRA) is a promise to reimburse or pay a specific amount toward insurable expenses incurred by a participant. This benefit is a Limited Purpose HRA for dental and vision expenses and will be offered to all employees. This is not dental or vision insurance. You are not required to enroll in the HP Cummings Medical Plan to be eligible for this benefit.

HP Cummings Construction Co. will contribute up to $500 for dental expenses and up to $100 for vision expenses to each employee. These reimbursements are for employee dental/vision expenses only and are not applicable to dependent expenses.

Flores will administer the Limited Purpose HRA. Employees will pay for dental and vision expenses out of pocket and the Limited Purpose HRA will reimburse employees directly from Flores when the employee submits the claim and funds are available.

If you enter the plan at a time other than the beginning of the plan year, the amount credited to your account will be reduced to reflect the time of actual participation.

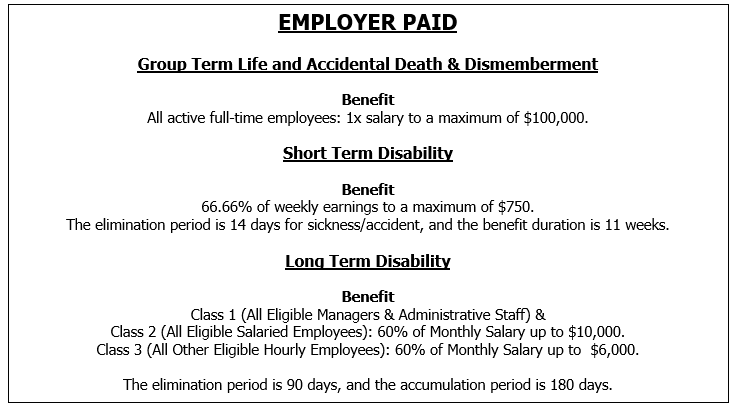

My Group Life and AD&D Benefits

HP Cummings gives eligible employees Life and Accidental Death & Dismemberment coverage. This benefit gives employees 1x salary to a maximum of $100,000.

Contributions

This is 100% Employer paid.

Eligibility

All full time Employees who work at least thirty two (32) hours per week are eligible for coverage following 90 days of continuous employment.

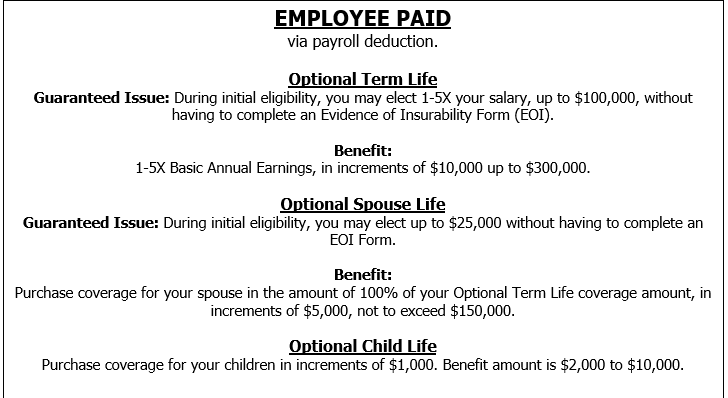

Voluntary Life and AD&D Benefits

Supplemental Life & AD&D Coverage is 100% Employee Paid and rates are based on Age Bands.

Any coverage request of over $100,000 for employees and over $25,000 for dependents and spouse requires Evidence of Insurability prior to coverage being granted.

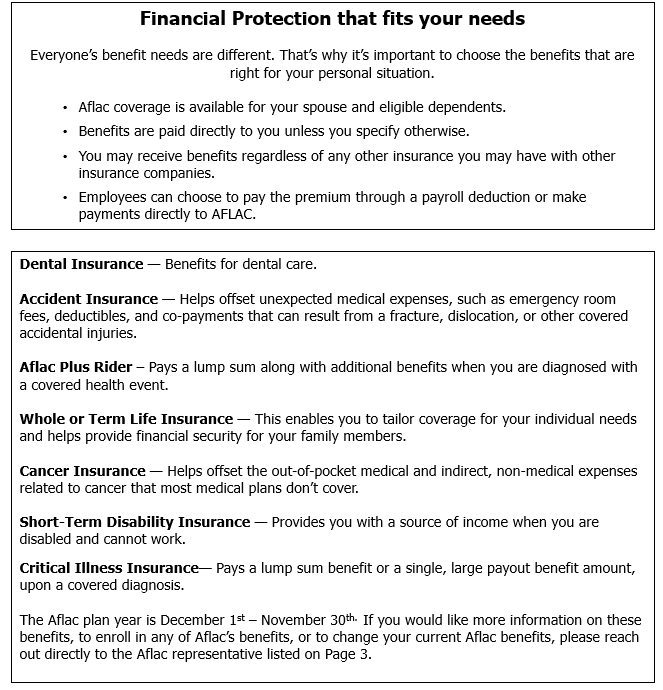

My Voluntary Benefits – Aflac

Contributions

100% employee paid

Eligibility

All full-time employees who work at least thirty two (32) hours per week are eligible for coverage the 1st of the month following 90 days of continuous employment.

Contact Information

Floyd Amidon Regional Sales Coordinator

(802) 753-7252

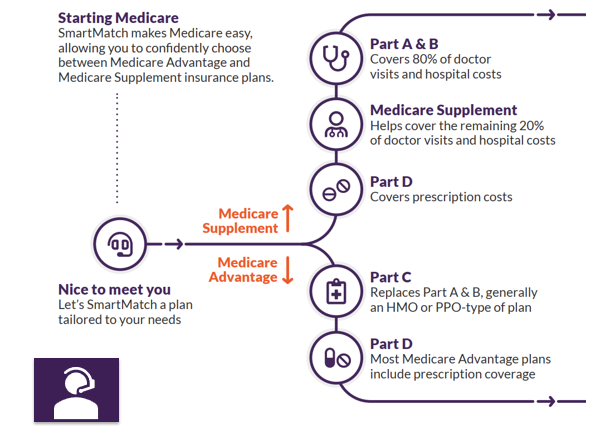

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Contact Information

Phone: 1-833-502-2747 TTY 711

For more information or to get started, please click on the following link:

Additional Information

My Retirement Benefits

- All full and part-time employees are eligible to contribute to the 401(k) &/or Roth IRA plan on the 1st of the month following 90-day eligibility.

- EE Deferral: Auto-enrollment provision of 5% with automatic 1% annual increases up to 10%. It can be changed by the employee. 100% invested in contribution.

- ER Match: 100% of employee’s contribution up to the first 3% of pay, then match 50% on the next 2% of pay.

Eligibility

All full and part time employees are eligible to contribute to the 401(k) &/or Roth IRA plan on the 1st of the month following 90 day eligibility.

Profit Sharing:

Employees are eligible on the closer of January 1st or July 1st after 1 full year of employment.

For Example: Hire Date of March 15, 2025, would be eligible on July 1, 2026.

Hire Date of July 15, 2025, would be eligible on January 1, 2027.

Profit Sharing is offered at company discretion, funds are put directly into 401(k) and are applicable to a vesting schedule.

My Tuition Assistance Benefits

Exciting Benefit for Employees!

The Richard’s Group tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a one-on-one consultation visit:

Forms and Plan Documents

My Additional HP Cummings Benefits

Bonus

HP Cummings pays out bonuses at company discretion.

Commuting Benefit

At times, field employees could be asked to commute to jobsites that HP Cummings considers above what is deemed ordinary home to work mileage. The commuting policy was put into place to compensate these employees for some of the additional time and expense incurred.

Per Diem Driving Commute

Field employees who do NOT operate a company vehicle and drive to a jobsite or ‘pick up’ address more than 30 miles from their home address are eligible for a per diem driving commute.

Per Diem Riding Commute

Field employees who do NOT operate a company vehicle and ride to a jobsite more than 30 miles from the pick-up address in a company owned or rented vehicle are eligible for a per diem riding commute. (Note, if a company or rented vehicle is available but not used the employee will only receive the riding commute per diem).

Superintendent Personal Use of Company Vehicle

See full policy for details.

Other Benefits

In-Lieu of Health

Those employees who waive company health coverage due to being covered under another plan are eligible to receive $45.32/week. Proof of coverage required.

Wellness

HP Cummings will reimburse 50% of qualified gym membership fees up to $25/month. Please see the full policy for eligibility and further information

Prescription Safety Glasses

HP Cummings will reimburse up to $160 every 2 years for qualified prescription safety glasses. Please see the full policy for eligibility and further information.

Company Referral Bonus

Earn up to $7500 by referring someone that HP Cummings hires.